Switching payroll providers can sound complex. Switching in the middle of the year even more so. Luckily, it’s not as difficult as it seems—especially in New Zealand and Australia.

Thanks to Payday Filing (NZ) and Single Touch Payroll (AU), modern payroll systems send employment data to the respective tax authorities—Inland Revenue (IRD) or the Australian Taxation Office (ATO)—every time you run a pay.

That means you’re not limited to switching payroll providers at the end of a month or financial year. Instead, you can safely move to a new payroll system whenever your business requires.

Learn more about switching payroll providers mid-year in this guide.

When should you switch payroll software?

Unlike much of the world, which has a financial year that runs the same as the calendar year, Australia’s tax year starts on July 1st, while New Zealand’s starts on April 1st. But since all modern payroll systems are compliant with Payday Filing or Single Touch Payroll rules, you can switch payroll providers at any time.

To determine if you need a new payroll system, ask yourself:

- Do I need particular features from my payroll software?

- Is my current payroll software enough for my growing business?

- Does my payroll vendor cause frequent issues with tax filing or employee payments?

- Should I choose a new provider with a different pricing structure?

- Does my current provider offer integrations with other accounting software I use?

Things to consider when switching payroll providers mid-year

Processing delays

While moving to a new payroll provider isn’t difficult, adjusting your payroll always runs the risk of errors that can cause processing delays. A late pay can make employees feel stressed, especially when the bills are drawing near.

It’s essential that your new payroll system is set up using the parallel payroll method to ensure that employee data and payment details are correctly transferred. Your new payroll provider should be able to guide you through the process if you need assistance.

Busy periods

You’ll likely find it easier to switch payroll companies when you have less on your plate. This all depends on your industry—for instance, most farms will be busier in the spring while retail ramps up business in the gift-giving seasons.

On the other hand, a new payroll software that properly meets your needs can help make accounting much easier when work is getting hectic! BizEx can advise you on the best time to change payroll providers.

Holidays

In many countries, the end of the financial year lines up with the Christmas holidays, when everyone’s out on break. The opposite is true for New Zealand and Australia.

Our summer holidays are smack bang in the middle of the tax year, and, depending on your industry, employees will be out of work enjoying their downtime. That means you’ll have to make time to teach employees about your new payroll system before everyone files for annual leave.

How to switch payroll software mid-year in four easy steps

1. Check your current provider’s terms

Before switching payroll service providers, review your current contract. Some companies charge early exit fees or require notice before cancellation. Make sure to understand any obligations so you can plan the transition without incurring penalties.

2. Select the right payroll provider

Think about what you need from a new payroll vendor. With so many options available, it’s important to choose payroll software that fits your business size and future growth. Some providers specialise in small businesses, while others cater to larger organisations.

Getting a free demonstration is a great way to test out the payroll process with a new provider before you commit. At BizEx, we offer a free demo of our BizPay payroll solution, allowing you to determine if it’s right for your needs before making a purchase.

3. Collect your payroll data

Once you’ve chosen a new provider, request historical payroll data from your current system. You’ll need to gather essential employee details, leave balances, and pay history.

4. Run parallel payroll

Run payroll in your old and new systems—A.K.A a parallel pay—for the next three pay cycles. This helps catch any discrepancies early, ensuring there are no major errors before you pay employees in the new system.

Payday 1

Process payroll using your previous system. Then, migrate data to your new system. You can do this by exporting employee data into a spreadsheet and importing it into the new software. If needed, ask your old payroll provider for help.

Ensure you notify your employees about the upcoming switch and guide them on using the new system.

Payday 2

Continue the payroll process as usual on the old system. Then, replicate the same pay run in the new software, but mark it as sent so that the payslips aren’t emailed to employees. This lets you review any errors before the start of the next pay period.

Payday 3

Connect your new payroll system to the Inland Revenue (NZ) or the Australian Taxation Office (AU), along with any other integrations. Finalise payment methods and inform staff that the transition is complete. You can now run payroll with your new provider!

Should you switch payroll companies mid-year?

The best time to switch payroll companies depends on your business’s needs. Consider your industry’s busy and quiet periods as well as pay cycles; moving to a new payroll company can take less time if you use a weekly pay period instead of a monthly one.

If you’re still unsure when to change payroll systems, contact an expert for assistance. BizEx can help you determine the best time to move your payroll solution—and with personalised training and support, we make the onboarding process simple.

Seamlessly switch payroll systems with BizEx

Changing payroll software providers is possible at any time of the year—it’s just a matter of what suits your business best. Your new provider will guide you through transferring your payroll information so that you’ll ensure compliance with tax laws.

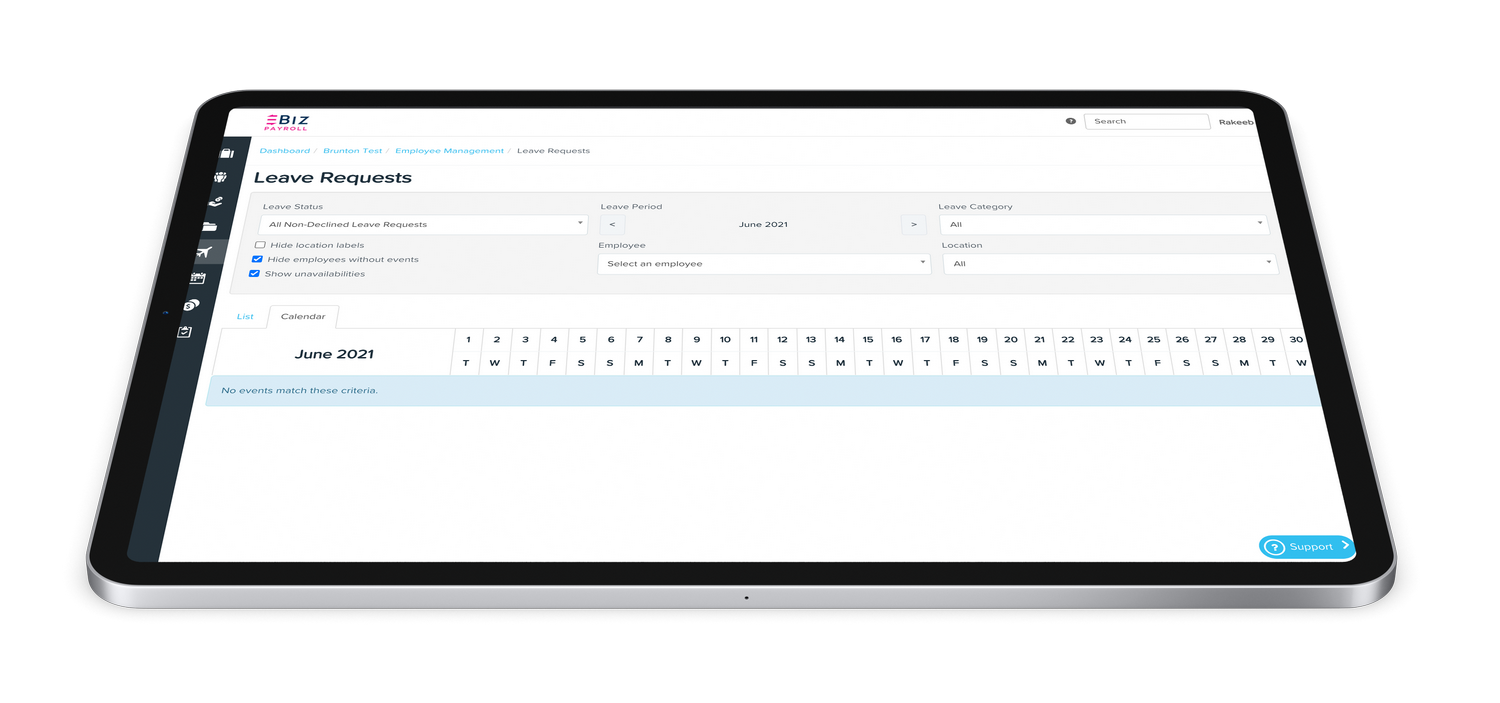

Looking to change payroll systems? Consider BizEx as your new payroll supplier. Our BizPay payroll solution is trusted by thousands of small businesses across New Zealand and Australia. With payroll, timesheets, rostering, and reporting in one software, we help companies boost their efficiency and save money and time on menial tasks.

Contact us today to book your free demo.